ProLogis to Purchase 20 Percent Interest in ProLogis European Properties Fund II Currently Held by ProLogis European Properties

December 19 2008 - 8:35AM

PR Newswire (US)

- Transaction Enhances PEPR's Liquidity - DENVER, Dec. 19

/PRNewswire-FirstCall/ -- ProLogis (NYSE:PLD), the world's largest

owner, manager and developer of distribution facilities, announced

today that it has agreed to purchase units representing a 20

percent interest in ProLogis European Properties Fund II (PEPF II)

from ProLogis European Properties (Euronext: PEPR) for

approximately euro 43 ($61.1) million. "In a difficult environment,

this agreement between ProLogis and PEPR benefits the shareholders

of both companies," said Walter C. Rakowich, chief executive

officer. "ProLogis' expanded ownership interest in PEPF II's

high-quality properties at an attractive price will yield greater

current income to ProLogis. At the same time, PEPR will be relieved

of the majority of its funding requirements to PEPF II, which

enhances PEPR's liquidity and financial flexibility. "We believe

this offers the best solution to PEPR's near-term liquidity issues,

while also offering ProLogis shareholders the prospect of enhanced

shareholder returns through increased ownership in PEPF II and

future upside from this portfolio of fully leased, recently

developed European industrial facilities," Rakowich added. "This

opportunity to purchase fund units at a discount to NAV is a unique

situation driven by PEPR's public market valuation and is in no way

applicable to our other, privately held fund structures. We are

cognizant of PEPR's liquidity issues and recommended this solution

to PEPR's board in our role as PEPR's external manager to benefit

both companies' stakeholders," Rakowich concluded. Terms of the

Transaction Following the close of the transaction, ProLogis will

own 37 percent of PEPF II units, comprising its previous 17 percent

direct ownership stake and the 20 percent purchased from PEPR.

ProLogis will assume euro 348 ($494.2) million of PEPR's future

equity commitments, which will be deducted from gross contribution

proceeds received by ProLogis over the next two years. The euro 43

million ($61.1 million) unit purchase price implies a discount of

approximately 30 percent to existing NAV and future funding

obligations. ProLogis is contractually obligated to maintain a 20

percent interest in PEPF II. PEPR will retain a 10 percent

ownership stake in PEPF II, which it will seek to sell to third

parties. If there is demand for more than the 10 percent of PEPF II

units to be offered by PEPR at better pricing than agreed to with

ProLogis, ProLogis will either sell the units purchased by it,

including the future funding obligation, and deliver the

incremental net proceeds to PEPR, or match the higher price for its

20 percent stake. If ProLogis is not required to match a higher

sales price, PEPR retains a 12-month option to repurchase the

two-thirds stake from ProLogis at the same price per unit.

Following this transaction, PEPR expects to have sufficient

liquidity from the sale of PEPF II units, the elimination of

two-thirds of its funding requirement for PEPF II, the elimination

of its dividend for the foreseeable future and the remaining

capacity on its line of credit to repay its debt maturing in 2009.

For further details, please refer to PEPR's press release at

http://www.prologis-ep.com/ The transaction is expected to close on

December 22, 2008. ProLogis' Action Plan On November 13, 2008,

ProLogis outlined an action plan to de-leverage its balance sheet

by at least $2 billion. The plan includes re-financing and/or

renegotiating debt maturities on ProLogis' balance sheet and in its

property funds, targeting regional portfolio sales, shrinking its

development pipeline through fund contributions and a halt in new

development starts, and retaining capital through G&A

reductions and lowering the dividend. About ProLogis ProLogis is

the world's largest owner, manager and developer of distribution

facilities, with operations in 136 markets across North America,

Europe and Asia. The company has $40.8 billion of assets owned,

managed and under development, comprising 548 million square feet

(51 million square meters) in 2,898 properties as of September 30,

2008. ProLogis' customers include manufacturers, retailers,

transportation companies, third-party logistics providers and other

enterprises with large-scale distribution needs. About ProLogis

European Properties (PEPR) ProLogis European Properties, or PEPR,

is the largest pan-European owner of high quality distribution and

logistics facilities. Established in 1999, PEPR is a real estate

investment fund (organised as a Luxembourg closed-ended fonds

commun de placement) externally managed by a subsidiary of

ProLogis. As at 30 September 2008, PEPR has a portfolio of 364

buildings, owned both directly and indirectly, covering 8.0 million

square metres in 12 European countries, with an open market value

estimated at euro 6.0 billion. Of the combined portfolio, PEPR's

directly owned properties comprise 246 buildings, covering 5.2

million square metres in 11 European countries, with an open market

value estimated at euro 3.9 billion. DATASOURCE: ProLogis CONTACT:

Investor Relations, Melissa Marsden, +1-303-567-5622, or , or

Media, Krista Shepard, +1-303-567-5907, or , both of ProLogis; or

Financial Media, Suzanne Dawson of Linden Alschuler & Kaplan,

Inc., +1-212-329-1420, or Web Site: http://www.prologis.com/

http://www.prologis-ep.com/

Copyright

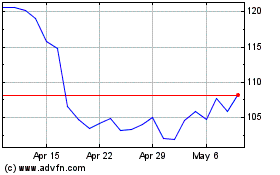

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

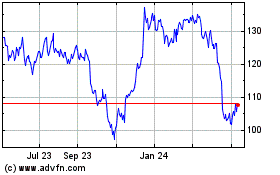

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024